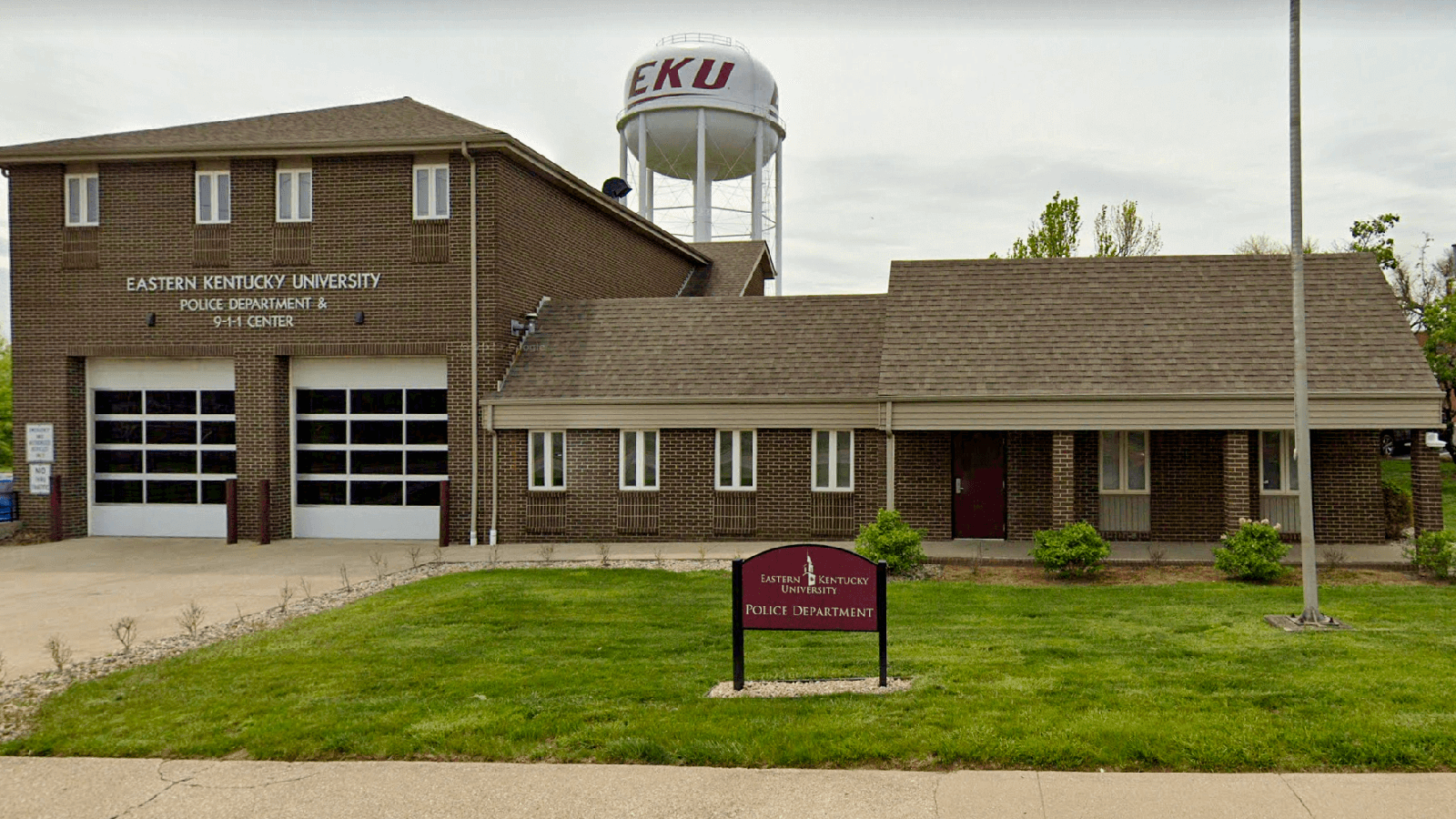

EKU Police Department

701 Vickers Drive

Richmond, KY 40475

859-622-1111

Fax: 859-622-2243

EKU Police Department

The Eastern Kentucky University Police Department provides 24-hour patrol of campus buildings, parking lots, residence hall exteriors, and campus grounds. Patrol is by motor vehicle, bicycle, and on foot. The department does not provide patrol services to the regional campuses, but may provide other services to include investigations and crime prevention programs.